[ad_1]

Bangkok, Thailand – Sheltering from the sun on a street corner, Kridsada Ahjed rues the day he got involved with the loan sharks who now gobble up most of his daily earnings.

“I went to the loan sharks because people like me – with no assets or savings – cannot qualify to get help from legitimate banks,” Ahjed, a 40-year-old motorcycle taxi driver, told Al Jazeera.

“Now almost everything I make in a day goes towards paying the interest on my debt.”

Kridsada is far from alone.

Thailand’s household debt reached nearly 87 percent of gross domestic product last year, according to the Bank of Thailand, among the highest on earth.

Nearly $1.5bn of that debt is estimated to be made up of high-interest informal loans.

Kridsada’s personal crisis is part of a wider malaise that has gripped Thailand’s economy

After decades of solid growth, Thailand is displaying all of the hallmarks of the middle-income trap, analysts say, where a combination of low productivity and poor education leaves much of the workforce stuck in low-paid, low-skilled work.

“Thailand suffers not only from the slow return of demand from major export markets, but also from the changing nature of globalisation that hurts its competitiveness,” Pavida Pananond, a professor of international business at Thammasat Business School, told Al Jazeera.

“International trade is being driven more by value-added services that require higher local skills and capabilities. This requires a systemic upgrading of the labour force and local firms’ sophistication beyond short-term handouts and investment incentives.”

Whereas other Southeast Asian countries are bouncing back strongly from the economic shock of the COVID-19 pandemic, Thailand has faltered.

Thailand’s economy grew just 1.9 percent last year, according to state economic planners, compared with growth of 5 percent or higher in the Philippines, Indonesia and Vietnam.

Even neighbouring Malaysia, a significantly more developed economy with lower expectations for growth, registered a 3.7 percent expansion.

Despite the recovery of Thailand’s key tourism sector, which accounts for about one-fifth of the economy, its prospects are not looking much better in 2024.

The World Bank on Monday said it expected the Thai economy to 2.8 percent this year, slightly better than Bangkok’s own estimates.

The Philippines, Indonesia, Vietnam and Malaysia are expected to see growth of between 4.3 and 5.8 percent.

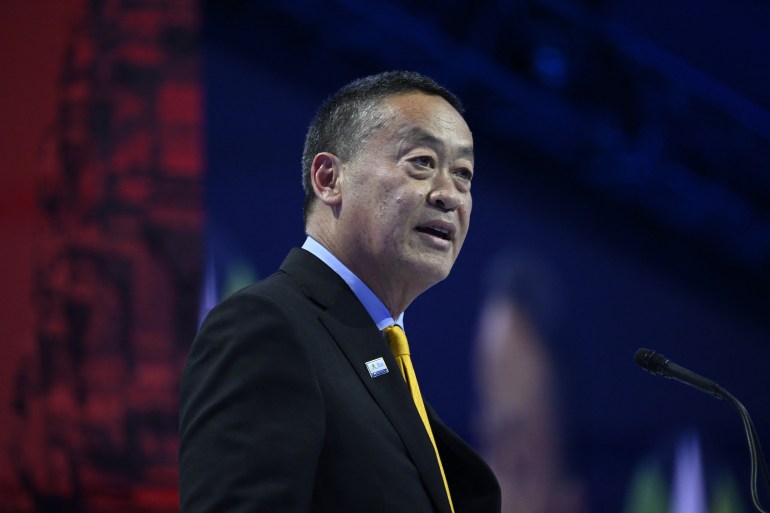

Thai Prime Minister Srettha Thavisin, who came to office in August after nearly a decade of military rule, has declared the economic situation a “crisis”.

Srettha, a property mogul-turned-politician, proudly calls himself the “salesman” of Thailand.

Since taking power in a compromise with the royalist establishment to block the reformist Move Forward Party, the 62-year-old political neophyte travelled the world to seek out free trade deals and promote the country as a base for global manufacturing supply chains.

But after years of Bangkok shirking from fundamental economic reforms, there are fears the economy may be resistant to a quick fix.

Critics say that Thailand’s military leaders for years turned off global investors, became too reliant on China’s economic rise and squandered the potential of young Thais by neglecting to fund an education system capable of producing a workforce suited to the digital era.

The World Bank said in a report released last month that two-thirds of Thai youth and adults were “below the threshold levels of foundational reading literacy”, while three-quarters had poor digital literacy skills.

Meanwhile, Thailand’s English language proficiency ranks among the lowest in the Association of Southeast Asian Nations (ASEAN).

To stimulate the economy, Srettha has proposed providing a 10,000-baht ($280) cash handout to virtually every Thai aged more than 16 – a policy economists and political rivals have slammed as wasteful – expanding visa-free entry to more countries, and legalising casinos.

“He faces political risks from ‘doing’ and ‘not doing’ these measures,” Move Forward Party deputy leader Sirikanya Tansakul told Al Jazeera.

“With the big cash handout scheme, he faces legal risks from unlawful government borrowing and of coalition discontent. But if he cannot implement this biggest electoral campaign, he faces public distrust.”

Srettha has also become embroiled in an unusually public dispute with the Bank of Thailand, which he has urged to cut interest rates to spur growth.

The central bank has refused to lower the benchmark rate, currently set at 2.5 percent, stressing the need to safeguard its independence.

In a bleak assessment earlier this year, Pranee Sutthasri, a member of the central bank’s Monetary Policy Department, said the country had “seriously lost its competitive edge”.

Sutthasri pointed to global forces – including China’s slowdown and the wars in Ukraine and the Middle East – as well as the kingdom’s failure to invest in training the population for the digital economy.

“It will continue to lag behind if, instead of making products related to artificial intelligence technology, Thailand keeps making downstream electronics products that people no longer want,” she told reporters in late January.

For Srettha, who was not the public’s first choice at the polls, a bad economy carries political risks.

“Political undercurrents that continue to meddle in domestic politics are red flags for investors,” said Pavida of Thammasat Business School.

“And now they have choices elsewhere without needing to wait until Thailand sorts itself out.”

For many Thais struggling to get by, the faltering economy brings more pressing practical concerns.

Hoo Saengbai, a 61-year-old lottery ticket vendor in Bangkok, said her monthly income has more than halved to as little as $110 over the last few years as people cut back on unnecessary spending.

“I’m not so sure about this government or any government any more,” she told Al Jazeera. “I’m just trying to put food on the table one day at a time. I eat if I earn anything, I don’t eat if I don’t earn. That’s all there is.”

[ad_2]

Source link